Tax Season Resources

Initial Tax Deadlines - Calendar Year Taxpayers

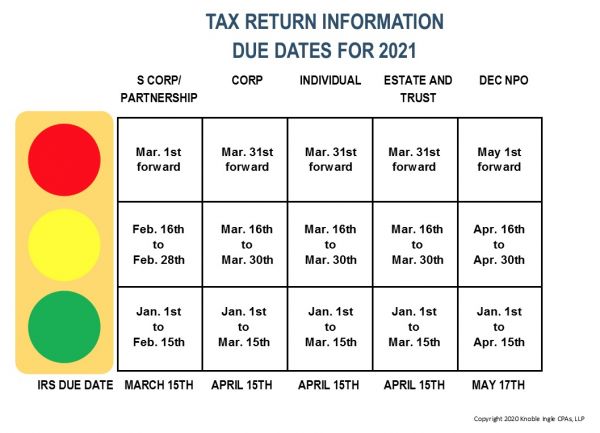

These are our preparation deadlines using our new Red, Yellow, Green format. To use the table, find the tax return you need to be prepared on the top, and go down the column for the preparation deadlines.

The RED deadline means your tax return will not be completed for this filing deadline and must be extended to prevent late penalties. This does not extend the time to pay taxes and if you expect to owe tax, you should make an estimated payment with your extension to minimize interest and late payment penalties.

Meeting the YELLOW preparation deadline means we may deliver your return on the due date (or even a few days later if complex K-1's and other documents are received late in the preparation process). When signing their electronic filing forms, taxpayers are confirming they have reviewed their returns. Not taking enough time for review causes significant risks that may result in late penalties. For these reasons, we suggest filing pro-active extensions to avoid last-minute problems.

To ensure filing on this first due date, be sure we have all of your information prior to the end of the GREEN deadline.

For extended due dates, see our Extended Preparation Deadlines. If you have any questions about the Red, Yellow, Green deadlines, please contact us.

Not-for-Profit and Non-Calendar Year-End Tax Return Due Dates

Non-profit tax return due dates are more complex to determine. All deadlines in the table above are for entities operating on the traditional December year-end. Business and Organizations operating on any year-end other than December have different IRS tax due dates. These clients should contact us for the Red, Yellow and Green deadlines based on their year-end.