Tax Season Resources

Extended Preparation Deadlines

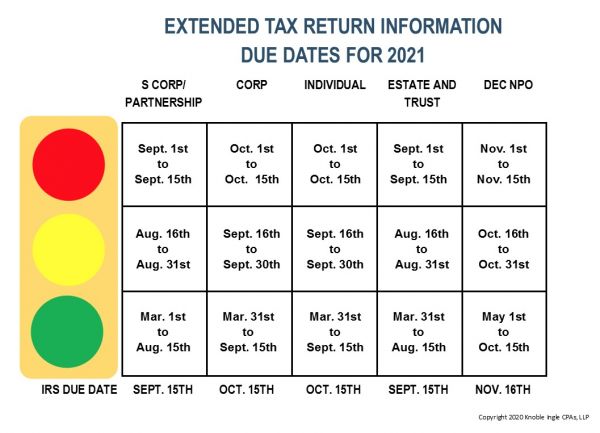

These are our extended preparation deadlines using our new Red, Yellow, Green format. If you extended your tax return or if you hit the RED deadline for the first due dates, follow these extended preparation deadlines.

To use the table, find the tax return you need to be prepared on the top, and go down the column for the preparation deadlines.

The RED deadline means your tax return will not be completed for this filing deadline and will be filed late. Because the return was already extended, filing it late causes late filing penalties and if tax is still owed, additional interest and late payment penalties.

The YELLOW deadline means we will attempt to finish preparing your tax return by the extended due date, to the best of our abilities. Late or missing documents will cause the preparation to take longer and, as a result, may cause additional penalties and interest. To ensure filing before the extended deadlines, please have all required information to our office during the GREEN dates.

To ensure filing before your extended deadlines, please have all of the required information to our office during the GREEN dates.

For standard due dates, see our First Preparation Deadlines. If you have any questions about the Red, Yellow, Green deadlines, please contact us.

Not-for-Profit and Non-Calendar Year-End Tax Return Due Dates

Non-profit tax return due dates are more complex to determine. All deadlines in the table above are for entities operating on the traditional December year-end. Business and Organizations operating on any year-end other than December have different IRS tax due dates. These clients should contact us for the Red, Yellow and Green deadlines based on their year-end.